Kreu / Per Bankat

Information for Banks!

- Attention towards bank workers

- Calculation of Prime

- Electronic Reporting

- Verification

- TEST YOUR KNOWLEDGE

Individual deposits in every bank operating in Albania are insured from ADIA in compliance with law no. 53/2014 “On Deposit Insurance”

Banks licensed from the Bank of Albania on deposits collection are subjects operating within the territory of the Republic of Albania and subject to the Albanian jurisdiction.Their membership in scheme is mandatory.

As member of deposit insurance scheme, first – time member banks have the obligation to pay initial contribution and afterward annual premiums on their depositors’ deposit insurance. In the case when a bank fails to pay deposits for the reasons related with its financial situation, ADIA compensates the depositors making use of these contributions and their investment proceeds.

In order to have e prompt and accurate compensation, in support of preservation of banking and financial stability in the county, it is very important:

1. An accurate depositors and deposit data entry:

2. Depositor awareness and information:

Quarterly insurance premium calculation method.

Period taken as example: January 1, 2016 – March 31 2016:

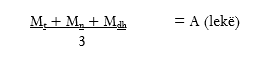

First step: simple average of insured deposits is calculated:

Shënojmë me

- “Mt Mn Mdh” – • MO, MN, MD – sum of insured deposits in ALL, as per last day of each previous trimester (October, November, December 2015)

- A – simple average of sum of insured deposits, registered in Bank, as per last day of each previous trimester

Second step: calculation of the sum of first trimester premium P1 (where 0.125% is the rate of trimester premium)

A × 0.125 ÷ 100 = P1 (lekë)

Ky prim paguhet brenda datës 15 janar.

Përllogaritja e shumës të depozitave të siguruara kryhet në përputhje me aneksin 11 “ Vlerësimi i shumës së depozitave të siguruara ” të Udhezimit “Për sigurimin e depozitave në banka”, të cilin e gjeni në seksionin Baza Ligjore .

Vlerësimi i shumës së depozitave të siguruara

Banka, në vlerësimin e shumës së depozitave të siguruara, përcakton depozitat e individëve që janë subjekt i skemës, në përputhje me nenin 3 “Përkufizime” pika 13, 14, 15, nenet 26, 31 32 dhe 33 pika 1, shkronja “a” të ligjit.

First case:

Depozituesi ka vetëm një depozitë individuale në lekë:

Në qoftë se kjo depozitë është më e vogël, se 2 500 000 (dy milion e pesëqind mijë) lekë, ajo sigurohet e plotë (përfshihet interesi ditor i llogaritur në ditën e vlerësimit të primit);

në qoftë se është më e madhe se 2 500 000 (dy milion e pesëqind mijë) lekë, sigurohet pjesa deri në nivelin 2 500 000 (dy milion e pesëqind mijë) lekë.

Depozituesi ka disa depozita individuale, të cilat janë në lekë dhe në monedhë të huaj. Depozitat në monedhë të huaj konvertohen në lekë sipas kursit zyrtar të Autoritetit Mbikëqyrës në ditën e vlerësimit, dhe më pas të gjitha depozitat agregohen. Shuma e gjetur nga agregimi, krahasohet me nivelin 2 500 000 (dy milion e pesëqind mijë) lekë dhe sigurohet pjesa e depozitës deri në nivelin e mbulimit.

Depozituesi ka disa depozita individuale dhe një ose më shumë depozita të përbashkëta me të drejta të plota. Në këtë rast bashkohen të gjitha depozitat individuale duke shtuar edhe pjesën koresponduese të depozitës të përbashkët, e cila ndahet në pjesë të barabarta midis titullarëve të saj, përveç rasteve kur përcaktohet ndryshe në kushtet e vendosjes së depozitës.

Për konkretizim, në rast se një depozitues ka një depozitë të përbashkët me një të afërmin e tij, një depozitë individuale dhe një tjetër të përbashkët me dy persona të tjerë ose më shumë, atëherë ky depozitues është disponues i gjysmës së shumës së depozitës që ka me të afërmin e tij, i depozitës individuale dhe i një të tretës së depozitës së përbashkët me personat e tjerë, ato bashkohen dhe sigurohet pjesa deri në 2 500 000 (dy milionë e pesëqind mijë) lekë.

Second case:

A depositor possess a deposit as a guarantee for a third person. In this case, the right for insurance is recognized to the deposit titleholder.

If the depositor holds other deposits in the bank, these are congregated with the deposit placed as guarantee and the amount until ALL 2,500,000 is insured.

Third case:

Depositor holds a conditional placed deposit or for a defined time (deadline), to the benefit to a third person. The insurance right is recognized to deposit titleholder, until the completion of deadline, or the defined condition. Otherwise, the insurance belongs to the deposit beneficiary. In case of a deposit placed to the benefit of a third person, with no condition or deadline, the right of insurance goes to the last. In case of deposits placed in benefit to more than one third person, regulations anticipated on full – right jointed deposits are applied. In this case, congregation is first applied and the amount up to ALL 2,500,000 is insured afterward.

The data collecting and reporting information system, aims at centralizing the electronic information reported to DIA by the banks, calculating each bank’s annual premium and carrying out rapid and efficient compensation in case of a bank resolution. This project was funded by an EBRD grant and FSVC contribution through FDIC’s high-level experts, who helped by compiling its terms of reference and performance evaluation. According to the project plan, the system design started on July 2013 and finished successfully on October 2014. Banks used it for the first time for premium calculations on October 2014.

Key functions of the System

The information system of the Agency and data reporting from the banks operates in such a way as to ensure:

Rules for Electronic Reports

For the purpose of calculation of insured amount, every bank uploads the following data files within first 10 days of the next month:

For each quarter in the first 10 days of the following month, the bank reports in the Agency the calculated prime for each depositor and uploads the corresponding file in the system.

In case of compensation process or simulation, the bank will be asked to upload daily files with the following data:

Also, the Agency can ask the banks for reports for special and unpredictable reasons to fulfill its public objectives.