Premium calculation

Quarterly insurance premium calculation method.

Period taken as example: January 1, 2016 – March 31 2016:

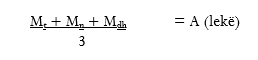

- First step simple average of insured deposits is calculated:

Let’s put down:

- “Mt Mn Mdh” – • MO, MN, MD – sum of insured deposits in ALL, as per last day of each previous trimester (October, November, December 2015)

- A – simple average of sum of insured deposits, registered in Bank, as per last day of each previous trimester

- Second step: calculation of the sum of first trimester premium P1 (where 0.125% is the rate of trimester premium)

A × 0.125 ÷ 100 = P1 (lekë)

This premium is payable within January 15.

The calculation of insured deposit sum is effectuated in compliance with the Annex 11 “Evaluation of insured deposits sum”, of the regulation “On bank deposit insurance”, found at the section Legal Framework.

Evaluation of insured deposits sum

In evaluation of insured deposits sum, the Bank defines individuals’ deposits subject of the scheme, in compliance with article 3, items 13, 14, 15 and articles 26, 31, 32 and 33 and 1/a of the law.

1. First case:

- Depositor holds one account only, in ALL:

If this deposit is less than ALL 2,500,000, it is completely insured (including daily interest, calculated in the day of premium calculation).

If this deposit is larger than ALL 2,500,000, only the amount up to ALL 2,500,000 is insured.

- Depositor holds several individual accounts (deposits), in ALL and foreign currency. Deposits in foreign currency are converted in ALL, as per official rate of Supervisory Authority, on the day of evaluation and all the accounts are congregated afterward. The total sum is compared with the level ALL 2,500,000 and that deposit portion is insured up to the coverage level.

- The depositor holds several individual accounts and one or more jointed full – rights deposits. In this case, all individual deposits are united, adding the corresponding part of the joint deposit, split on equal parts between its account holders, unless otherwise stated under the conditions of account opening.

Concretely, if a depositor possess a jointed deposit with his/her relative, one individual deposit and on other jointed one with two or more persons, than this depositor is possessor of half of deposit amount he/she possesses with his/her relative, of his/her individual deposit and one third of the jointed other jointed one. All these are summed up and the amount up to ALL 2,500,000 is insured.

Second case:

A depositor possess a deposit as a guarantee for a third person. In this case, the right for insurance is recognized to the deposit titleholder.

If the depositor holds other deposits in the bank, these are congregated with the deposit placed as guarantee and the amount until ALL 2,500,000 is insured.

Third case:

Depositor holds a conditional placed deposit or for a defined time (deadline), to the benefit to a third person. The insurance right is recognized to deposit titleholder, until the completion of deadline, or the defined condition. Otherwise, the insurance belongs to the deposit beneficiary. In case of a deposit placed to the benefit of a third person, with no condition or deadline, the right of insurance goes to the last. In case of deposits placed in benefit to more than one third person, regulations anticipated on full – right jointed deposits are applied. In this case, congregation is first applied and the amount up to ALL 2,500,000 is insured afterward.