- EBRD providing €100 million stand-by credit line to Albanian Deposit Insurance Agency

- Promoting financial stability and confidence in banking sector

- Technical cooperation to strengthen operational capacity and governance

Banka Europiane për Rindërtim dhe Zhvillim (BERZH) do të ofrojë një linjë kredie prej 100 milionë Euro për Agjencinë Shqiptare të Sigurimit të Depozitave që do të ndikojë në rritjen e stabilitetit të sektorit bankar në vend dhe sigurisë së klientëve.

The credit line, fully guaranteed by the government of Albania, will provide back-up liquidity following the severe impact of the Covid-19 pandemic on the economy. The funds will be available to compensate insured depositors, reassuring commercial and private bank clients.

EBRD President Odile Renaud-Basso said: “We are very pleased to sign this agreement today, as it is a vital contribution to the stability of Albania’s financial sector and demonstrates the EBRD’s commitment to the country. We are determined to support Albania in its eventual recovery from the economic impact of the pandemic and would like to see the country return to robust and sustainable growth as soon as possible. For this, a sound, stable and secure banking sector is vital and we are fully committed to contributing to this.”

Anila Denaj, Minister of Finance and Economy, said: “The signing of this agreement marks the successful completion of a long process of cooperation between the Albanian government, ADIA and the EBRD. The €100 million stand-by credit line to ADIA is a demonstration of trust and support from the EBRD to the Albanian economy and financial sector institutions.”

Genci Mamani, General Director of ADIA, said: “The agreement we signed today with the EBRD is in line with our legal objectives to protect the interests of depositors and to contribute to the stability of the banking and financial system. This credit line is considered an additional mechanism which adds to our security elements, as it will strengthen the financial capacity of the deposit insurance scheme by guaranteeing the necessary liquidity in case of insurance events within a very short time. It will also increase the level of depositors’ protection, both at the level of insured deposits and at the level of financial institutions.”

In addition, a €270,000 technical cooperation programme funded by the Luxembourg Official Development Assistance Technical Co-operation Fund will strengthen ADIA’s operational capacity and governance. The project includes the introduction of an automated payout process, the modernisation of the internal reporting system and laying the foundations for the introduction of a risk-based premium approach.

ADIA was founded in 2002 as an independent public institution. Its mission is to protect individual depositors and to pay out insured deposits in case of bank failure, with an overarching objective of strengthening the stability of the banking and financial system in Albania. The EBRD supported the institution with funding and technical assistance for the first time in 2013.

The EBRD is a leading institutional investor in Albania. To date, the Bank has invested more than €1.5 billion in 112 projects in the country.

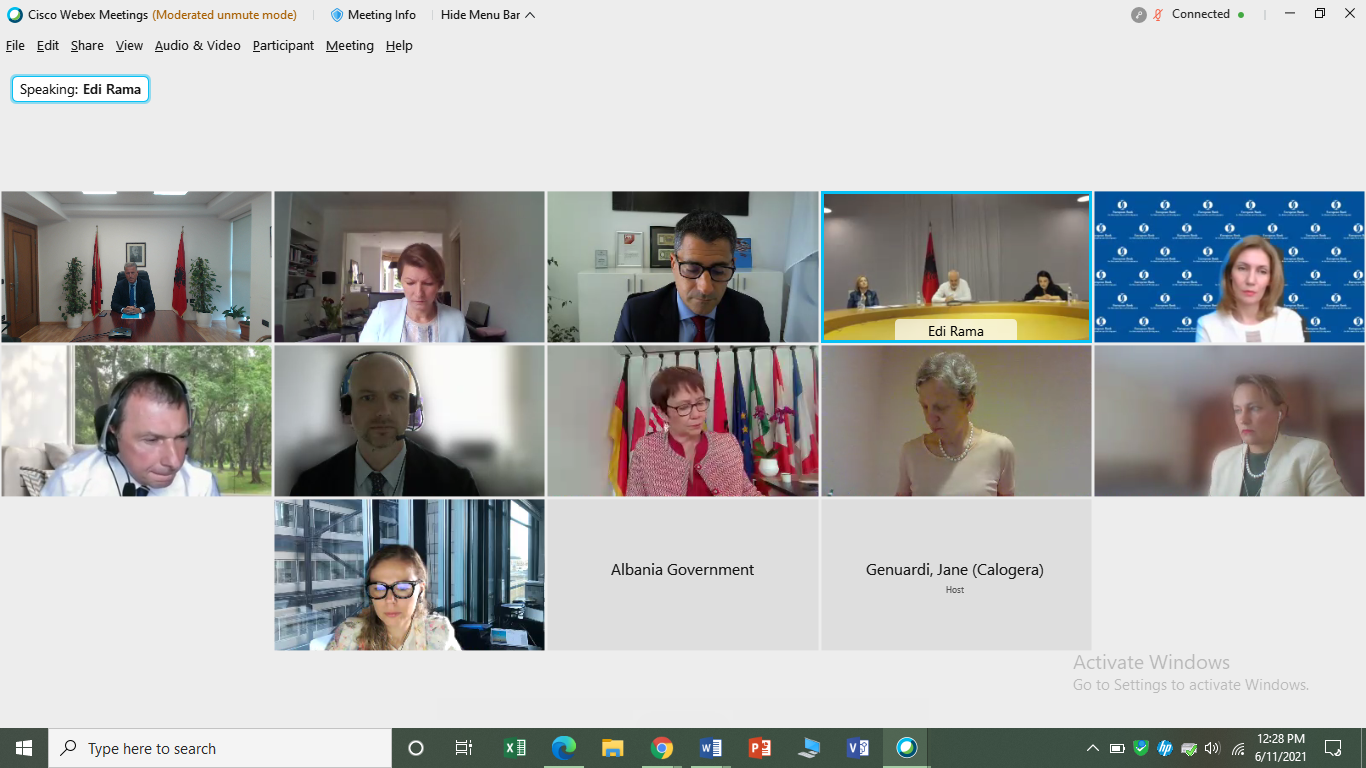

ADIA_EBRD_signing-ceremony